JWG Radar Reporting Service

JWG is uniquely positioned to offer bespoke regular Radar Reports, based on real-time data from its horizon scanning platform RegDelta, combined with careful analysis from its highly experienced team. This allows clients to quickly understand existing and new regulatory changes, impacted controls and overall control risks.

Clients have achieved massive returns on their JWG Radar Reporting Service investment, through highly focused business growth, the limitation of risk and the need for expensive remediation programmes.

The current problem

Professionals at the coal face struggle to stay on top of regulatory changes which affect their markets. Email alerts from professional services firms highlight offer broad brush overviews, but miss much of the important detail. This means that business opportunities are missed and risks are introduced, resulting in expensive remediation programmes

A comprehensive & trusted approach

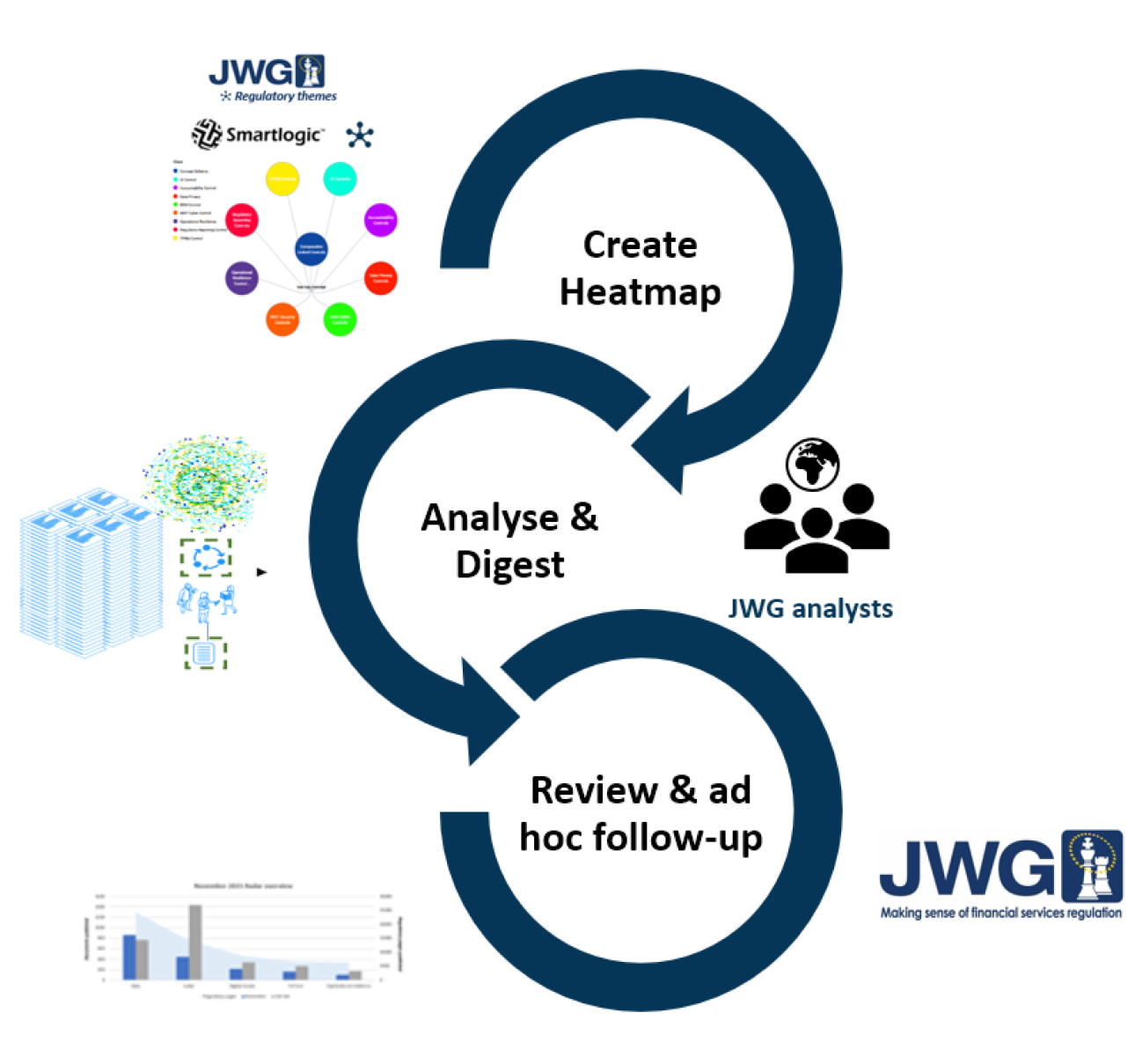

JWG regulatory analysts work with your team to understand your business’ regulatory heatmap derived from our comprehensive, global taxonomy of regulatory themes. Our team produces bespoke radar reports and takes you though the updates on a timetable to suit your needs. If you would like, we can take on ad hoc analysis between scheduled reports.

Service overview

Why JWG?

JWG is uniquely positioned to offer bespoke regular Radar Reports, based on our global network, regular collaboration with the industry and real-time horizon scanning data. No other service provider occupies this niche.

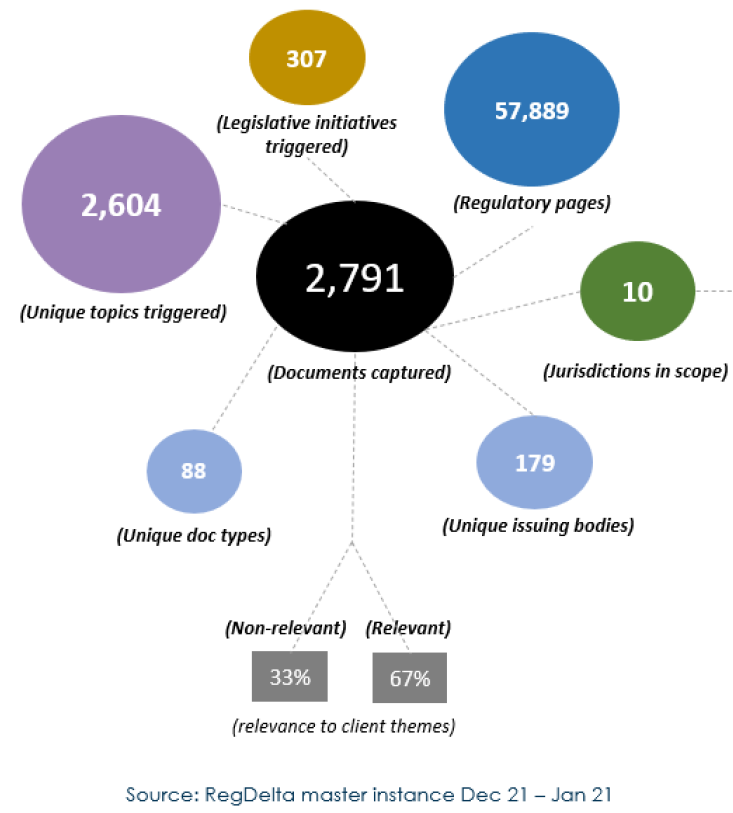

Radar Service Snapshot

JWG analysts have used RegDelta to analyse over 21,000 documents to pinpoint Client risks and opportunities generated by regulatory initiatives across the globe.

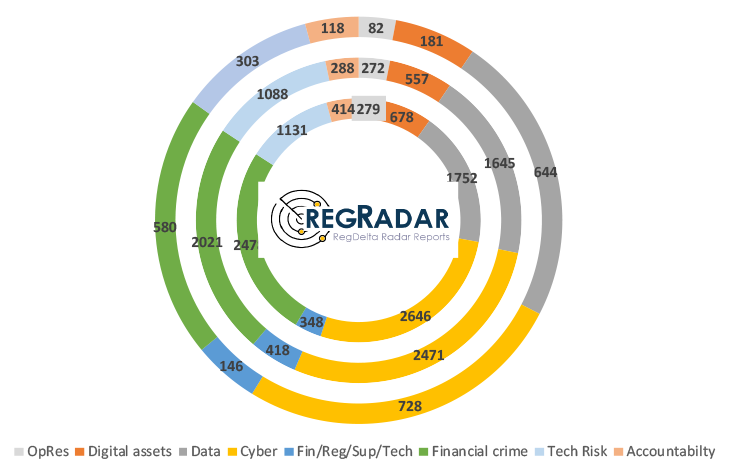

Global RegRadar quarterly document count by theme

Source: RegDelta master instance, Sep 21 – Feb 22; 847,201 pages from 21,268 documents

We use RegDelta’s powerful tagging and comprehensive data feed to filter the noise so your team is out in front of the latest developments, mitigating your risk of missing out and cutting the cost of trolling through emails. p;

| Theme | 2022 Topic and regulatory initiative highlights |

| Trading/ Digital assets |

|

| Data |

|

| Cyber |

|

| Operational resilience |

|

| FinTech SupTech RegTech |

|

| Financial crime |

|

| Technology Risk |

|

Source: Summary of JWG’s RegRadar analysis – Q321- Q122

Talk to us about how we can take away the pain of detailed tracking, reduce costs and make sense of your regulatory agenda.

RegCast

Our RegCast, ‘Implementing RegTech control solutions’ discusses the areas that need to be considered when looking at the market offerings and what it takes to deploy next generation data feeds..

How you can use RegDelta

At JWG, we understand the stress of onboarding a new application internally, and that’s why we have created a seamless onboarding approach to minimise the impact on BAU.

RegTech Intelligence

Your comprehensive library of in-depth articles, white papers, surveys, reports and analytics, covering ever changing regulatory obligations and how new technology ensures compliance.

Explore RegTech IntelligenceRegTech Community

RegTech Communities provide a dedicated, safe space where financial institutions, regulators, trade associations and technology suppliers come together to stay ahead of sector demands.

Explore RegTech Community